Categorie

- Il nostro blog (57)

- I nostri progetti (62)

- FAQ (6)

A maggio 20, 2025, Infolink Consulting ha rilasciato il suo Q1 2025 Database della catena di approvvigionamento di accumulo di energia globale, Segnalazione delle spedizioni cellulari di accumulo di energia globale di 99.58 GWh, UN 150.62% aumento di anno in anno, nonostante un 7.75% declino da un quarto di quarto. Fattori basati sulla politica, compresi gli Stati Uniti. Impatti tariffari e pre-May della Cina 30 Rush di installazione, ha sostenuto una forte domanda in una stagione tipicamente più lenta.

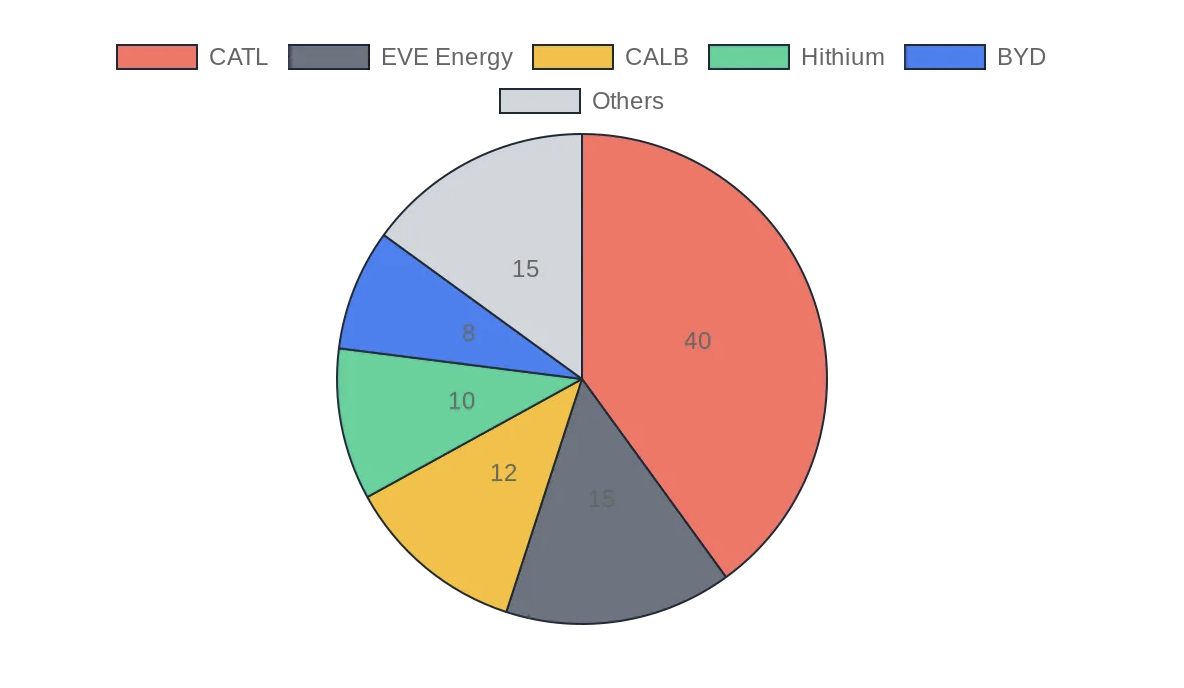

The top 10 manufacturers (CR10) captured 90.1% of global shipments, underscoring high industry concentration. The top five companies in Q1 2025 were:

Catlus – Solidifying its position as the market leader.

Eve Energy – Holding strong in second place.

CALVO – Rising to third for the first time, driven by partnerships with clients like Sungrow.

Hitio – Securing fourth place.

BYD – Rounding out the top five.

The chart below illustrates the market share distribution among the top five companies, with the remaining share held by other CR10 players.

The gap in market share among the second to sixth-ranked companies (Eve Energy, CALVO, Hitio, BYD, and Rept Battero) is narrowing, signaling intensifying competition. Samsung SDI secured a top 10 spot, driven by a major order from NextEra.

Large-scale storage cell shipments reached 92.85 GWh, su 160.08% anno su anno. The top five players—CATL, Eve Energy, CALVO, Hitio, and BYD—remained consistent for three quarters, though rankings shifted. The market share gap among the second to fifth players is now within 3%, indicating fierce competition in 2025.

The 300Ah+ cells dominated with a 65% share in the large-scale storage market. High-capacity cells, including CATL’s 587Ah, EVE Energy’s 628Ah, and CALB’s 640Ah, are expected to enter mass production between Q2 2025 and Q2 2026.

Portable storage cell shipments grew to 6.73 GWh, su 66.83% anno su anno. The top five players were EVE Energy, Rept Battero, Poweramp, Xinwanda, and Gotion High-Tech. The market is evolving from a duopoly of EVE Energy and Rept Battero to a three-way race with Poweramp, as these companies compete with similar product portfolios and customer bases.

The chart below compares the shipment volumes for large-scale and portable storage markets in Q1 2025.

The Q1 2025 data highlights a dynamic energy storage market, with CATL leading while competitors intensify their rivalry in both large-scale and portable segments. As high-capacity cell production scales and market concentration persists, 2025 will likely see heightened competition and technological advancements.

Source: InfoLink Consulting, Maggio 20, 2025