Categorie

- Il nostro blog (57)

- I nostri progetti (62)

- FAQ (6)

Aumento della tariffa di importazione della batteria al litio statunitense:

UN nuovo gioco energetico che influenza il mondo

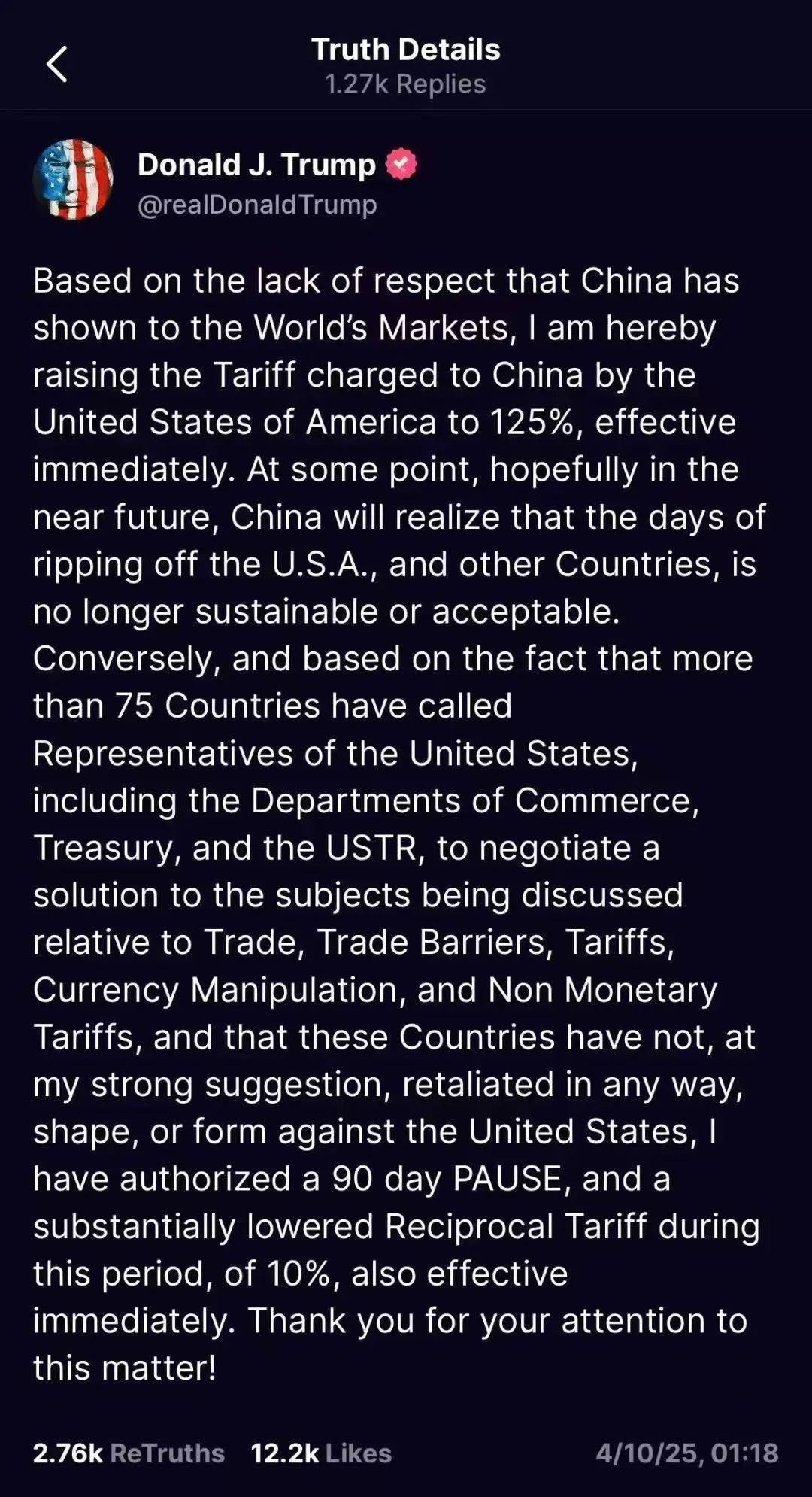

SU 10 aprile 2025, Il presidente degli Stati Uniti Donald Trump ha annunciato tramite i social media la sua decisione di sollevare tariffe sulle importazioni originate in Cina 125%, effetto immediatamente. Prima, Il governo degli Stati Uniti aveva annunciato un aumento delle "tariffe reciproche" sulle esportazioni cinesi negli Stati Uniti da 34% per 84% , efficace 9 aprile. Il governo cinese ha risposto rapidamente annunciandolo, efficace 10 aprile 2025, l'aliquota tariffaria sulle importazioni di origine statunitense verrebbe aumentata da 34% per 84%.

* La “lotta segreta” dietro le tariffe: per cosa combattono gli Stati Uniti?*

L'intenzione originaria degli Stati Uniti era quella di aumentare le tariffe batterie al litio, puntando direttamente ai due obiettivi principali: “reflusso industriale” e “sicurezza energetica”.

Ambizioni produttive locali: Negli ultimi dieci anni, gli Stati Uniti hanno rappresentato solo 6% della capacità produttiva mondiale di batterie al litio, basandosi fortemente sulle importazioni (La Cina rappresenta 75% di capacità globale). L’aumento delle tariffe ha lo scopo di costringere le case automobilistiche e i produttori di batterie a trasferire le loro linee di produzione negli Stati Uniti, replicare il percorso del Chip Act nel settore dei semiconduttori e rilanciare la produzione.

Un microcosmo di rivalità geopolitica: Dietro questa politica c’è la preoccupazione per il dominio della Cina nella nuova catena energetica. Gli Stati Uniti stanno cercando di indebolire la dipendenza dalle importazioni attraverso barriere tariffarie, mentre spinge i suoi alleati (per esempio., LG della Corea del Sud, La Panasonic giapponese) accelerare la costruzione di fabbriche negli Stati Uniti e costruire una catena di fornitura “de-chinaizzata”..

Punto controverso: la politica sembra proteggere le imprese locali, ma gli Stati Uniti nel breve termine non dispongono di una completa raffinazione dei materiali al litio e di una capacità di produzione di batterie, il “disaccoppiamento” forzato può portare a carenze di approvvigionamento. Il CEO di Tesla Musk ha pubblicamente interrogato, “Aumentare le tariffe è come frenare l’industria delle auto elettriche”.

* L’“effetto farfalla” della filiera industriale: chi ne trae beneficio? Chi si fa male?*

Dolore a breve termine: Aziende di veicoli elettrici che fanno affidamento su batterie importate (per esempio., Riviano, Lucido) stanno affrontando costi alle stelle, e potrebbe essere costretto ad aumentare i prezzi di alcuni modelli 5-10 per cento, minando la competitività del mercato.

Dividendi a lungo termine: stimolato dalla politica, Aziende cinesi come CATL e Svolt stanno accelerando la loro cooperazione con Ford e Tesla per costruire fabbriche attraverso il modello di licenza tecnologica; SK On e Samsung SDI della Corea del Sud hanno annunciato ulteriori investimenti negli Stati Uniti, e si prevede che la capacità produttiva locale triplicherà 2030.

Gli aumenti dei prezzi dei veicoli elettrici potrebbero rallentare il ritmo di penetrazione e andare contro l’obiettivo 50% penetrazione dei veicoli elettrici da parte 2030. Ma se la filiera locale matura e i costi scendono, c'è ancora spazio per l'immaginazione a lungo termine.

Risonanza emotiva: Un utente statunitense ha twittato sui social media, “Il governo dice sempre “Compra americano”, ma al mio portafoglio interessa solo quando potrò comprarne uno $30,000 un’auto elettrica a prezzi accessibili.’

Le imprese cinesi nel settore delle batterie si sono rivolte al Messico e al Sud-Est asiatico per costruire fabbriche ed evitare dazi attraverso l’accordo USA-Messico-Canada; mentre l’Europa ha colto l’opportunità per attrarre investimenti nei materiali midstream e rafforzare la produzione localizzata.

Dati chiave: In 2023, La batteria al litio cinese le esportazioni sono aumentate del 87% anno su anno, ma la percentuale delle esportazioni verso gli Stati Uniti è diminuita 35% per 18%, e la tendenza alla “riduzione del rischio” della catena industriale è evidente.

* Tlui il prossimo 10 anni : tre principali tendenze nel settore delle batterie al litio*

Sostituzione tecnologica accelerata: Batterie solide, batterie agli ioni di sodio e altre nuove tecnologie potrebbero rompere il modello esistente, ridurre la dipendenza dalle risorse di litio, e quindi indebolire l’impatto delle barriere tariffarie.

Le filiere regionalizzate prendono forma: Il mondo formerà un modello “tripolare Cina-USA-Europa”., e le case automobilistiche dovranno creare capacità di produzione localizzata in ciascuna regione per evitare rischi politici.

L’ascesa dell’economia circolare: NOI. aziende locali di riciclaggio delle batterie (come i materiali in sequoia) trarranno vantaggio dall’inclinazione politica, batterie usate come “mine urbane” o diventare un nuovo campo di battaglia.

* Conclusione: Oltre il gioco, È necessaria una collaborazione globale*

L’essenza della controversia tariffaria è la lotta dei paesi per il diritto di parola nella nuova era energetica. però, il cambiamento climatico non conosce confini, e le batterie al litio non sono solo una merce, ma anche uno strumento chiave per raggiungere la neutralità del carbonio. I politici devono diffidare del “pensiero a somma zero” – se si consentirà alle barriere commerciali di prevalere sugli obiettivi climatici, l’umanità potrebbe pagare un prezzo più alto. Per la gente comune, l’esito di questo gioco determinerà direttamente se potremo abbracciare un futuro più pulito a un costo accessibile.

FINE

*********************

La batteria Lyth non è solo un fornitore di celle della batteria al litio, ma anche un professionista produttore di moduli e pacchi batterie al litio. Non utilizziamo i tipi di batterie di utilizzo del gradiente . Non importa per le singole cellule, Moduli o pacchetti della batteria, Lyth usa solo nuovi tipi di celle di grado A completi con un rapporto di test originale .

Per ulteriori informazioni o per effettuare un ordine, Visita il nostro sito Web o contatta il nostro team di vendita oggi!

Mobile / WhatsApp / Wechat: +86 13603880312

E-mail: info@lythbattery.com