Catégories

- Notre blog (54)

- Nos projets (59)

- FAQ (6)

Introduction:

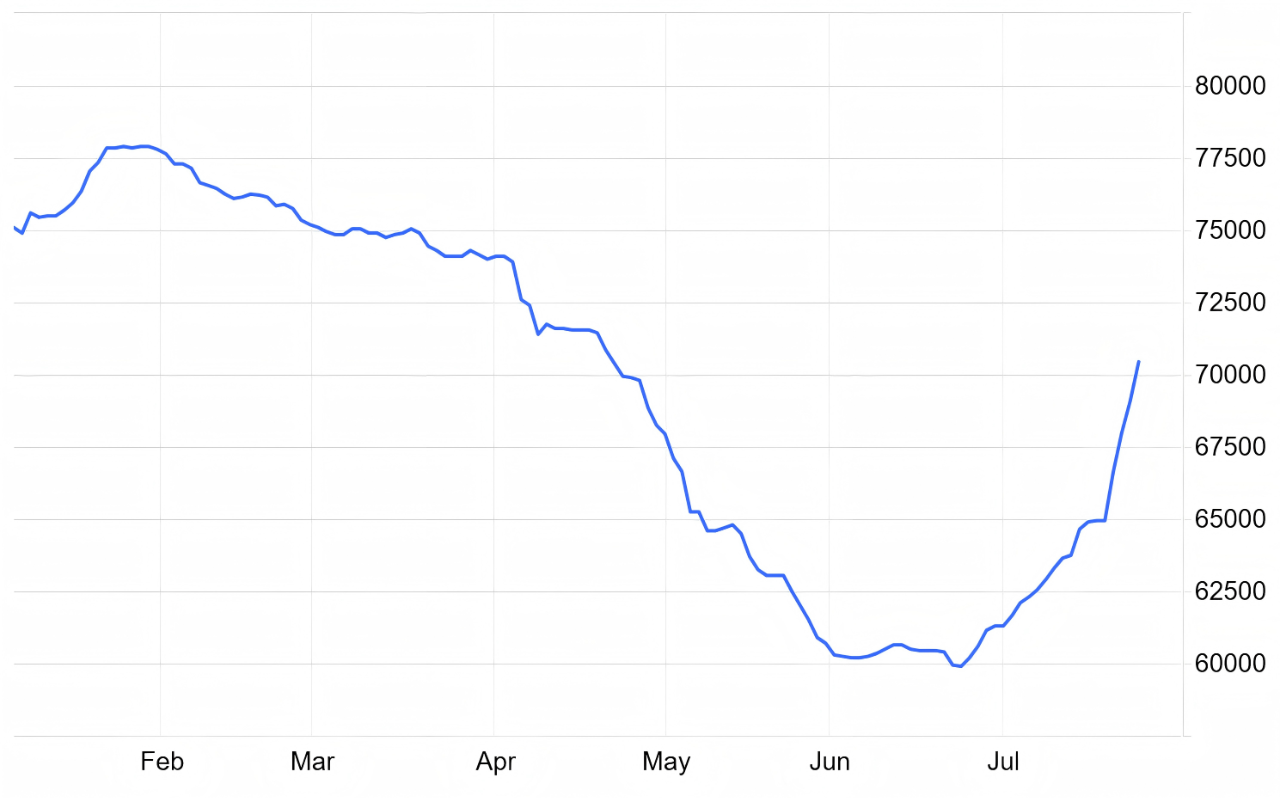

Récemment, Le prix du marché du carbonate de lithium de qualité batterie en Chine a montré un rebond important. Les dernières données indiquent que le prix a dépassé le seuil de 70 000 ans, atteinte 72,900 Yuan par son, avec une augmentation cumulée dépassant 20% Au cours du dernier mois. Notamment, Les gains de prix au comptoir quotidien sont dépassés 1,000 yuan / tonne pour plusieurs jours de négociation consécutifs avant.

Price Trend Review

According to continuous monitoring by the CESA Energy Storage Application Branch’s industry database, the average domestic price of battery-grade lithium carbonate entered a downward trend starting in May 2024, falling from above 100,000 yuan/ton to below 80,000 yuan/ton. After hitting a temporary low in September the same year, it experienced a slight rebound. Prices stabilized in Q1 2025 but declined again from April to June, dropping from 74,100 yuan/ton to below 60,000 yuan/ton. Since July, however, the market has reversed course, with prices rebounding rapidly.

Policy Drivers and Market Response

Industry analysts widely attribute the current price surge in July to recent policy developments. On July 18, Xie Shaofeng, Chief Engineer of the Ministry of Industry and Information Technology (MIIT), stated at a State Council press conference that growth-stabilization plans for ten key industries—including steel, non-ferrous metals, petrochemicals, and building materials—are forthcoming. MIIT will prioritize structural adjustments, supply optimization, and the elimination of outdated capacity in these sectors.

Following these policy signals, the non-ferrous metals market rallied strongly, with coking coal, steel, and glass prices reaching new highs alongside lithium carbonate. Experts note that this rebound stems from policy guidance, supply-side adjustments, and marginal demand recovery. It also aligns with the domestic new energy industry’s intensified “anti-involution” efforts and pursuit of high-quality development.

Solid Demand Underpins Prices

Historically, lithium carbonate price volatility has closely tracked the rapid growth of downstream new energy vehicles (NEVs) and energy storage sectors. Demand-side drivers include sustained high growth in China’s new energy industry, rebounding NEV sales in Europe, expanding energy storage installations globally, and explosive growth in Southeast Asian markets. These factors collectively bolster demand for lithium batteries and upstream raw materials, supporting expectations of further near-term price increases.

Energy Storage Boom Fuels Battery Cell Demand

Energy storage demand has been particularly robust. In the first half of 2025, both international and domestic markets saw accelerated growth, driving significant demand for energy storage battery cells. CESA’s data reveals:

From January to June 2025, Chinese companies secured 199 overseas energy storage orders/partnerships, totaling over 160 GWh, un 220.28% Augmentation en glissement annuel.

Domestic energy storage procurement (including DC-side equipment) reached 46.1 GW/186.7 GWh during the same period, with capacity surging 243% en glissement annuel et 50% quarter-on-quarter.

Supply Constraints Trigger Price Rises

Strong demand is now impacting supply chains. Several system integrators have reported receiving price hike notices from battery cell manufacturers. Industry sources indicate increases of “at least 10%,” noting that tier-1 suppliers face severe shortages (“difficult to secure a single cell”), while some tier-2 brands are also nearing stock depletion. This confirms an ongoing wave of price increases for energy storage cells.

Industry Advisory: Given the current trajectory of lithium carbonate prices and tightening cell supply, LFP (LiFePO4) cell costs are projected to rise imminently. We advise potential buyers to finalize procurement plans promptly to mitigate cost impacts.

Long-Term Perspective: Volatility, Not Crisis

Despite the uptick, July’s price recovery is not a prelude to revisiting the historical peak of 600,000 yuan/ton (2022 high). Instead, the industry views it as a temporary fluctuation amid lithium battery sector’s transformation from “scale dominance” à “value-driven” quality advancement.

Procurement Opportunity: While long-term stability is expected, near-term cell price increases are inevitable. LYTH offers competitive lithium-ion battery solutions designed to navigate market volatility while ensuring supply chain resilience.

Sodium Batteries Gain Strategic Opportunity

The current price rally has also reignited interest in sodium-ion battery technology. This trend may extend the “time window” for sodium batteries to expand their market presence, offering alternatives amid lithium cost volatility.

Integrated Energy Solutions: Alongside emerging sodium technologies, LYTH provides a full portfolio of lithium-ion batteries tailored for diverse applications. Explore our solutions to optimize your energy strategy.

ACT NOW:

With lithium raw material costs rising and cell supply tightening, procurement timelines are critical. Contact the LYTH team today for:

Real-time LFP cell pricing analysis

Lock-in strategies for upcoming orders

Customized lithium battery solutions

📞 Consult now to secure pre-increase inventory